A premium audit ensures you’re paying the right amount for your coverage. Learn about the premium audit process and get prepared with answers to these frequently asked questions.

Why is my policy premium being audited?

What is the audit for?

The audit helps to make sure you paid the right amount and had the right coverage for your business, based on actual numbers instead of estimates.

Why do I have to do an audit?

Audits are required by law for certain types of policies in all states. In fact, states can impose hefty penalties if you don’t do your audit – up to three times the amount of your original policy.

Why would my policy premium be adjusted?

When we issued your policy, we based your premium on estimates of your business exposures. Those are things like what type of business you run, your employees’ job duties, payroll totals, sales, etc. During the audit, we collect the information we need to learn your actual exposures. Then, we’ll compare your estimated premium with your actual premium. Depending on how that goes, you may owe us additional premium, or we may owe you a return.

I canceled my policy/no longer have coverage from The Hartford. Do I still have to do the audit?

Yes. Even if your policy is no longer active, we still need to make sure you paid the right premium while it was. The audit doesn’t reactivate your policy. It just helps us make sure you paid the right amount for your coverage.

Can my accountant or other party do the audit for me?

Yes. Your accountant will need to log in to your account and add your policy to their service center account. Then, they’ll be able to access what they need to do the audit on your behalf. You’ll continue to get reminders until we receive the audit submission.

Why isn’t the premium audit based on the calendar year?

Your audit is for the policy period that just ended—whatever that means for your policy. Most policies start during one year and end in the next year.

Why do I have to provide quarterly tax returns if the audit isn’t based on the calendar year?

The point of the audit is to make sure you paid the right amount for the right coverage over the full course of your most recent policy term. Using your quarterly tax returns helps us keep our numbers more accurate, which keeps your premium cost as accurate as possible.

Does the audit of my last policy term have an effect on my current term?

It might. We don’t audit a policy term until it’s over. But we do compare the audit information from your last policy term to the coverage you currently have. If there are significant differences between your audit result and the assumptions, we used to set your current premium, we may change your current policy. You should also let us know when something changes, so we can adjust your policy if needed as the term goes on.

The goal is to keep your premium payments as accurate as possible. You’ll receive a policy endorsement for any changes to the current term.

I’m about to submit my audit records. What do I need to know?

Is it safe to upload confidential records to The Hartford online portals?

Yes. The Hartford takes pride in securing our customers personal financial records. For more information please visit The Hartford Online Privacy Policy.

Can I start the audit and come back to it later?

Yes. Every page of the online audit has a Save button, so you can leave and come back later. Next time you log in, the audit will still be filled in up to the last place you saved.

Will the screen time out for inactivity?

Yes. To help keep your account safe, your session will time out after 20 minutes of inactivity. But every page of the online audit has a Save button, so the next time you log in, you can pick up where you left off.

What do I do if the file is too large to upload?

The secure portal accepts .zip file extensions, so we recommend zipping them to shrink the size of the files.

I have a list of items to gather. What does it all mean and what are the records used for?

Why do you want a profit & loss/income statement, tax return, or subcontractor/1099/off-payroll labor report for a workers’ compensation audit?

We use these documents to validate the existence of potential exposure from individuals/businesses you may have paid outside of your payroll (subcontractors/off-payroll labor). If you didn’t use any non-payroll labor, we use the profit & loss/income statement or tax return to confirm that. If you did, we use the information to review who you paid for which services and determine your final exposure.

Más información sobre workers' compensation audits.

What if my business tax return is not yet filed for the year that falls within the audit period?

We understand the tax return from last year may not be filed for several months. If that’s the case, please provide the most recently available filed tax return (i.e. 2021 in lieu of 2022).

What is a certificate of insurance (COI), and why do you want it?

COIs are used to prove that a business or individual maintains a particular type of insurance coverage. We want it to make sure your exposures line up with the people you employ, including subcontractors.

The auditor may determine that a subcontractor creates an exposure for your business and include them in premium. However, if a subcontractor maintains their own insurance, they can either be excluded from your policy (workers’ compensation) or included at the much lower subcontractor rate (general liability).

Más información sobre certificates of insurance.

Which certificate(s) of insurance (COI) do you want?

We want COIs from any subcontractors that you paid to perform services on your behalf. The subcontractor’s COI should show the type of coverage that corresponds to your policy (workers’ compensation, or general liability). The subcontractor’s COI should show coverage dates that roughly coincide with your own policy dates (at least half of the policy period).

What is a California DE-9?

A California DE-9 is a state unemployment/payroll quarterly filing for businesses in California.

What if my 941/California DE-9 is not yet filed for the quarter that falls within the audit period?

Provide the corresponding quarter from the prior year (i.e. Q4 2021 in lieu of Q4 2022). Or, you can provide a separate payroll report for the missing quarter in question (i.e., 10/01/2022 - 12/31/2022 in lieu of Q4 2022 941/DE-9).

Why do we need a California contact?

It’s part of CA state rules. We need the California contact to validate state-specific business operations and employee responsibilities. California performs random test audits, comparing their results with ours to ensure that we are applying all audit rules properly.

Why do you want the payroll report in Excel?

Having a report in Excel decreases the chance of errors. It also helps us review the data more efficiently and improves our accuracy when finding any credits or deductions that may apply. Most payroll companies have an Excel report and can help if you need it.

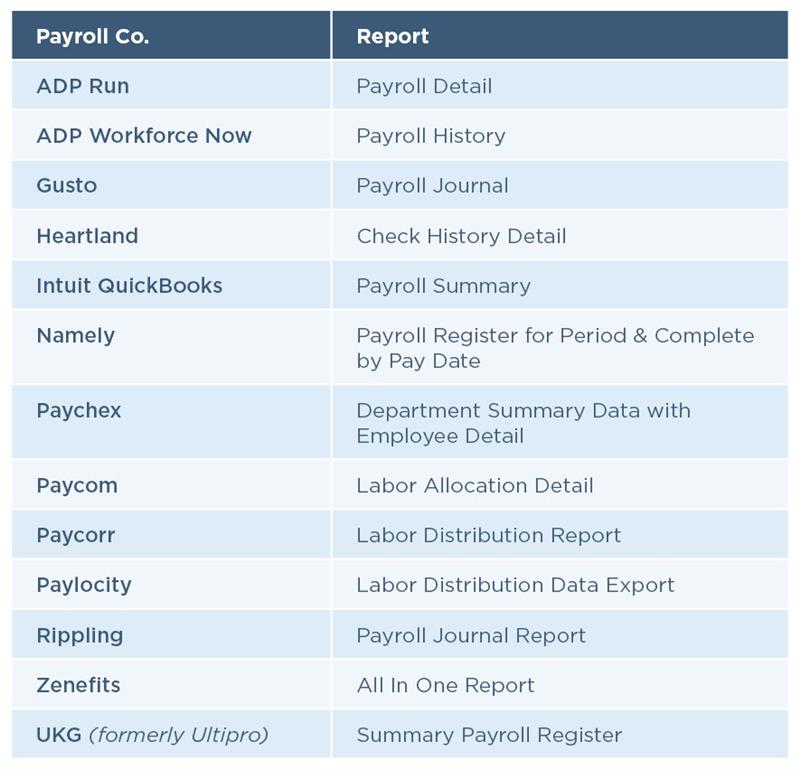

If you use one of these payroll companies, here’s the report we’d need from them:

Preferred Report by Payroll Company

What are off-period payroll reports and why might they be requested?

Many policy dates don’t align to the quarters in your 941s. Off-period payroll records help us reconcile the policy period payroll gross to the filed quarterly 941 totals. Example: For audit period 08/01/2021-07/31/2022, the off-period reports we’d want are 07/01/2021-07/31/2021 and 07/01/2022-07/31/2022.

What is Section 125 (Cafeteria Plan) and why do you want it?

Section 125 is an employer-sponsored benefit plans that let employees pay for qualified medical expenses such as health, dental, vision, etc. We need these totals for the policy period, by employee. The information helps us reconcile to the 941s. They’re also a potential credit for employees in the state of California.

Why are you requesting officer/partner/member verification documents?

These individuals are treated differently for premium audit purposes. They’re subject to minimum and maximum payroll caps as well as inclusion/exclusion rules, so we need to make sure we know who they are. We validate these individuals by reviewing specific forms in the business tax return (1125-E, K1s, Schedule C, etc.), or other formal records such as corporate meeting minutes, state filings, etc.

What type of sales records do you need for sales-based policies such as general liability?

We need a report for the audit period that shows total gross income/sales. Examples of acceptable sales records include profit & loss statements, income statements, sales journals, sales tax reports, sales by customer reports, etc. We compare these sales figures to the most recently filed tax return, which helps us identify yearly fluctuations.

Why do you need start and end dates for commercial automobile audits?

Having the start and end dates for added/removed fleet vehicles allows us to pro-rate the length of time the vehicle was in service, potentially reducing your total premium.

Más información sobre commercial auto insurance.

What if I have a “pay as you go” policy?

I have a pay as you go policy. Don’t you have my payroll information already? Why do I still have to do an audit?

We get some payroll information through the year, but it’s all summarized. We don’t receive any detailed payroll reports or the 941s we need to verify that those summaries were correct. We do the audit to make sure that all wages were received, officers were properly handled, credits properly applied where applicable, etc.

Plus, the audit doesn’t just verify your payroll. We also review:

- The classifications assigned to your business and employees to make sure they were accurately reported throughout the year

- Information outside of payroll and employees, such as the use of subcontractors

Más información sobre pay as you go workers' compensation.

Why do you want the pay as you go payroll report in Excel?

Having a report in Excel decreases the chance of errors. It also helps us review the data more efficiently and improves our accuracy when finding any credits or deductions that may apply. Most payroll companies have an Excel report and can help if you need it.

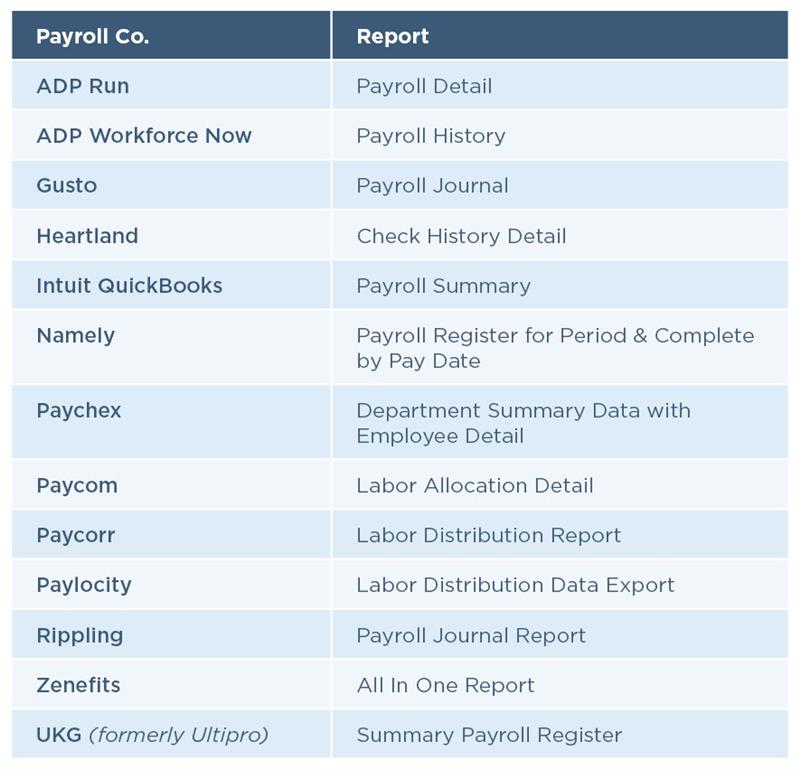

If you use one of these payroll companies, here’s the report we’d need from them:

Preferred Report by Payroll Company

Why don’t you want my payroll company’s “Workers’ Compensation Report”?

Workers’ comp reports don’t have all the details we need for an accurate audit. They typically leave out things like true gross figures (which we need to reconcile to the 941s), and other items (total overtime, tips, severance, etc.) that we need to review/analyze before applying the appropriate state rules.

What can I expect after I submit my audit?

What happens after I submit my audit?

We’ll review your submission and reach out with any questions. It usually takes about three weeks to complete an audit. When we’re done, you’ll get a Statement of Premium Adjustment with the results. The statement isn’t a bill, but it’ll let you know if you owe us money, or if we owe you money.

What is the Statement of Premium Adjustment?

The Statement of Premium Adjustment shows you how we adjusted your premium at the end of your policy term. Not sure why we do that? See Why is my policy premium being audited?

The Statement of Premium Adjustment is not a bill. It’s there to show you the detailed results of how your premium may have changed from the original estimate, based on your actual numbers.

- If the numbers are the same, there’s nothing you’ll need to do.

- If you overpaid, we’ll pay back some of your premium. You’ll get the amount as a credit to your account.

- If you owe money, the entire amount that you owe will be included on your next scheduled bill. We’ll expect payment in full to close out this past policy term.

I don’t understand my Statement of Premium Adjustment. Can you help me break it down?

Absolutely. The Adjustment is designed so that you get high-level information at the top, and it gets more specific and detailed as you go down. There are three main sections:

The Premium Audit Summary is a quick snapshot of your audit outcome. In this section we compare your original estimated premium with the total audited cost of your policy. If you overpaid, we’ll pay back some of your premium. If you owe money, the entire amount that you owe will be included on your next scheduled bill. We’ll expect payment in full to close out this past policy term.

If you need help with a payment plan or want to pay with a credit card, call 866-467-8730.

The Entity, Location and State section goes into your “exposures.” Depending on what kind of business you have, your “exposures” are either your payroll numbers or your sales numbers. Where the Premium Audit Summary section does a quick before-and-after of your original estimate vs. your actual cost, this section gives a more detailed breakdown by entity, location and/or state.

In a Revised Final Audit, this table will compare the exposure numbers from your last audit with your new/revised numbers.

The Rating Detail is the math section. It breaks down everything that goes into how we calculate your premium. Basically, the math goes like this: Your exposure x your rate ÷ the rating basis = your premium.

Here’s an example of how it works for a workers’ comp premium:

Your Exposures (Payroll or Sales)

x Your Rate

÷ 100

= Your Premium Amount

We divide by 1,000 for general liability.

You’ll find a breakdown of all your business locations by state. Every location has a Standard Premium table where you can find the class code and description, applicable rate and total premium for each exposure group. Por ejemplo:

If you have multiple locations within a state:

- We’ll list each location separately.

- We’ll summarize taxes and surcharges in the Other Premium Taxes and Surcharges grid.

- You’ll find a total cost for each state. We then combine those state totals to get your Policy Audit Total Cost amount, which is the same number you’ll find in the first two sections of your Statement of Premium Adjustment.

How do I get my refund if you owe me money? How do I pay if I owe you?

If you overpaid, we’ll automatically put your refund amount toward your next bill. If you’re paid up in full, we‘ll send you a check. If you owe money, the entire amount that you owe will be included on your next scheduled bill. We’ll expect payment in full to close out this past policy term. If you use automatic payments, we’ll withdraw the amount on your next scheduled withdrawal date.

If you need help with a payment plan or want to pay with a credit card, call 866-467-8730.

What if my audit says it was “estimated”?

My audit says it was “estimated.” What does that mean? Why are you using an estimate and not real numbers? Can it be revised?

We estimate an audit for two reasons. Either you didn’t complete your premium audit, or you did the audit but didn’t provide enough information. We can revise your audit if you provide the documentation we need to complete our review. And it’s a good idea to send in that info – depending on what state you’re in, your premium could increase by up to three times the amount of your policy premium if you don’t do the audit.

Your original audit request will have the instructions on how to complete your audit. If you don’t have the original request, call us at 866-467-8730 and select the option for questions related to your audit. You can also email us at esc.audit@thehartford.com.

I do not agree with the outcome of my audit. Can I dispute it? Who can I speak to if I have further questions?

I don’t agree with my audit results. Who can I talk to?

If you think your audit results aren’t accurate, you can open a dispute. Email us at esc.audit@thehartford.com to get started. We’ll ask for specific documentation showing where you believe something doesn’t match up. We’ll also want any tax/payroll records or certificates of insurance if you didn’t provide them when we first reviewed your policy.

Who do I contact if I have additional questions?

Email the premium audit team at PremiumAuditTeam@thehartford.com